tax loss harvesting limit

When an asset is sold. You can take that loss and deduct it from your total capital gains so you would only have to pay taxes on 4000 of the gains you made from selling your energy stock.

Tax Loss Harvesting Definition Example How It Works

This is how tax-loss harvesting acts as a critical strategy to save tax for many investors.

. Answer Simple Questions About Your Life And We Do The Rest. 15000 from the Rs. Use the power of tax-loss carryforwards.

3000 per year for individual filers or married couples filing jointly or 1500 per person per year if you are married filing separately. Annual Limit to Harvesting Tax. Look at your brokerage statements and see which investments are showing a loss.

Is There a Limit to How Much Tax-Loss Harvesting Can Be Used Annually. 100s of Top Rated Local Professionals Waiting to Help You Today. There is a 3000 limit on capital losses that can be deducted annually from your ordinary income think of it as a deductible IRA contribution.

Tax Loss Carryforward. A tax loss carryforward is a tax policy that allows an investor to use realized capital losses to offset the taxation of capital gains in future years. Currently the amount of excess losses you can claim as a deduction is the lesser of 3000 1500 if youre married and file separately or the total net loss that appears on line 21 of Schedule D on your tax return.

There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Tax-loss harvesting is commonly seen in portfolios with stock holdings but can be done with other securities such as bonds options ETFs and mutual funds. By harvesting that loss she can now offset those 2000 in gains with it so her short-term capital gain is reduced to 500 on which shell now only pay 120 in taxes a reduction of 75.

As a married couple filing jointly or a single filer you can realize up to 3000 of capital losses to reduce your ordinary taxable income in a given year. If the net capital loss is less than or equal to 3000 1500 if you are married and filing a separate tax return then that entire capital loss can be used to offset other types of income. Is there a limit to tax-loss harvesting.

The upside of losing is limited to 1500 to 3000 a year. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct.

35000 as against Rs. There are some rules to keep in mind. However there is no limit to capital.

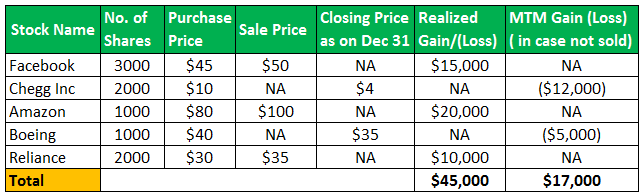

135000 and you will pay tax only on Rs. Tax-loss harvesting limit. Because you lost 5000 more than you gained 25000 20000 you can reduce your ordinary income by 3000 potentially lowering your tax liability an additional 1050 3000 35 for a total savings of 8050 7000 1050.

When used correctly tax-loss harvesting can help you realize significant tax savings. 15 lakh gain for tax calculation. To max out your taxable loss youll need to find investments where youve lost at least 9000.

You can only do tax-loss harvesting in your taxable brokerage accountsnot in 401ks or IRAs. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Learn More At AARP.

However you can remove this Rs. 2000 x 24 480 2000 - 1500 500 500 x 24 120. Use this also to find the ideal assets for gift giving or charitable donations.

Ad Stay Connected to the Most Critical Events of the Day with Bloomberg. However there are limits to the amount of taxes on ordinary income that can be offset. You could then apply the remaining 2000 of your capital loss from Investment B 5000 3000 to.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. You have to use short-term losses to offset short-term gains and long-term losses to offset long-term gains but if you have excess losses in either category they can be applied to either type of gain. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

50000 you would have paid otherwise. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. Whenever total capital gains and losses for the year add up to a negative number a net capital loss is incurred.

Investors are allowed to claim only a limited amount of losses on their taxes in a. In the 24 tax bracket that would come out to 024 4000 960 paid in short term capital gains and 015 4000 600 in long term capital gains. You can use any.

Identify appreciated lots for your clients Sell winning investments to realize gains for clients. Online Assist add-on gets you on-demand tax help. So your effective LTCG will be Rs 15 lakh Rs.

Before the end of the year she notices another position with an unrealized loss of 1500.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Automated Tax Loss Harvesting Wealthfront

Tax Loss Harvesting Everything You Should Know

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

When Not To Use Tax Loss Harvesting During Market Downturns

Tax Loss Harvesting Definition Example How It Works

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages